Melrose Industries, an engineering company that seeks to acquire businesses it understands, improve them by a mixture of investment and changed management focus, realise the value created and then return it to shareholders. I have a holding in my income portfolio (epic code: MRO).

Melrose Industries announced their interim results today and declared that revenue for the continuing businesses in the

period was £780.9m down 11% and 5% at constant exchange rates.

Adjusted profit

before tax, which excludes discontinued operations, exceptional items and amortization, was £109.9m a rise of 2% and 10% at constant exchange rates. Reported earnings for the period for continuing operations was £50.3m an increase of 6.8%. Adjusted EPS, excluding discontinued operations, exceptional items, amortisation and using the number of shares in issue at 30 June 2014 for both years, was 7.3p, an increase of 2.8%

and 11% at constant currency. Reported EPS on a continuing basis was 4.4p an

increase of 22.2%.

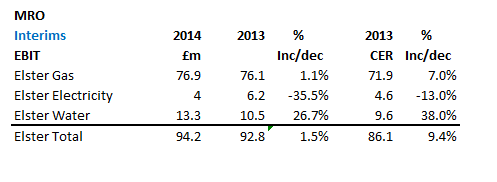

Melrose's profits have been severely affected by weak currencies for Elster compared to last year. Using constant exchange rates improves the 1.5% growth (before central costs) to 9.4% showing the underlying performance in this part of the business:

|

| Click on table to enlarge |

An interim dividend of 2.8p was declared representing an increase of

just 1.8%, that probably reflects their caution for the year when they state in their outlook that "...Economic recovery in Asia, the USA and the UK, while somewhat underwhelming by historical standards, nevertheless looks strong compared with continental Europe and some other parts of the world. The uneven nature of this recovery has made it unusual and harder to forecast..."

Free cash flow (FCF) at £29.3m was below the £63.3m from last year, but that did include operating cash flows of £25.3m from discontinued operations. After returning capital of £595.3m and paying a final dividend of £53.6m, net debt was increased from £140.8m at the end of the year to £750.6m, representing gearing of 50%. Debt represented a reasonably comfortable 2.4x their trailing twelve months EBITDA (their bank covenant requirement is 3.25x)

This is a reasonable result for the business, but as we have seen in other international companies, struggling with foreign currency headwinds due to the strength of sterling. Melrose over the past three years has suffered from weak FCF, being below their weighted average cost of capital; they have mitigated this by selling businesses at very good multiples to provide shareholders with very good total returns in excess of 20% pa compound over the last 4 years. So the weak FCF is probably a feature of the improve (reorganisation costs) and invest (high capital expenditure) to sell.

No comments:

Post a Comment