A global defence, aerospace and security company. BAE Systems delivers a range of products and services for air, land and naval forces, as well as advanced electronics, security, information technology solutions and support services. I have a holding in my income portfolio (epic code: BA.)

BAE Systems announced their interim results yesterday and were in line with expectations. Sales in the first half declined by 10.3% to £7.6bn, with approximately 4.7% of the decline due to foreign exchange translation.

Operating profits declined by 8.4% to £689m and underlying EPS declined by 1.1% to 17.7p. Statutory EPS increased by 7.1% to 13.5p, due to lower finance and corporate tax charges and a 2.1% reduction in the average number of shares due to the buy-back programme. The interim dividend was increased 2.5% to 8.2p.

Free cash flow was negative at -£0.3bn, but was an improvement on the -£1bn from last year. The cash generation was made positive by the receipt of £0.4bn from the sale and leaseback of two properties in Saudi Arabia. The net debt position at the half year was £1.2bn an increase of £0.5bn from the year-end, as payments were made of £0.4bn for dividends and £0.2bn for share buy-backs.

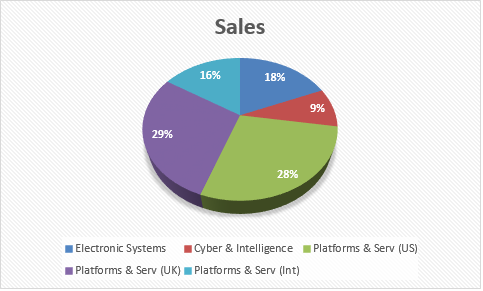

The order backlog was down £3bn from the year-end, but still represented good visibility at £39.7bn. Overall performance by division was:

Electronic Systems Division was in line with expectations. Although margins improved for Cyber & Intelligence, sales were down by 13%, due to US budget pressures. As expected Platform & Services (US) was below last year as the Bradley reset activity almost halved. Platform & Services (UK) was below last year as Typhoon deliveries are heavily weighted to the second half, 12 were delivered in the first half and 30 planned for the second half. Although Platform & Services (International) sales was down 5% on last year, although this was due to foreign currency translation from the Euro and Australian Dollar.

With respect to the outlook for the year management have said that "...Sales are anticipated to be weighted towards the second half of 2014..." and "...excluding the impact of exchange translation, the Group remains on track to deliver earnings in line with our expectations for the full year..."

Guidance from management for the full year (excluding the effects of foreign exchange translation) is for underlying EPS to be 5-10% lower than 2013, which would place it in a range of 37.8p to 39.9p. At today's share price of 426p, expectations would place it on a multiple of between 10.7 to 11.3x with a 4.8% yield - still good value.

Although 2012 saw the first fall in global military expenditure in real terms since 1998, recent events around the world have created a need for more, not less military expenditure. With just the UK and USA achieving NATO targets for defence spending of 2%, there will be pressure for increases as the world becomes less stable. As a strong global supplier, BAE will be a beneficiary of increased defence spending.

No comments:

Post a Comment